Investors who trade frequently and spend $5 or more per trade can easily rack up thousands of dollars in annual commissions (or even a month for active traders). Trading can begin with a variety of accounts and varying minimum deposits. If you want to trade with the Per-Trade plan, you’ll need a balance of at least $2500. A more in-depth explanation of the Per-Trade plan can be found in the Spreads & Commissions subsection.

The exceptions

to this are Skrill and PayPal, which fund within the same day, and credit card

withdrawals, which post within 5-10 minutes. For all of our broker reviews, we research, validate, analyse and compare what we deem to be the most important factors to consider when choosing a broker. This includes pros, cons and an overall rating based on our findings.

Social Ad Tribe Review ( : Are Sean Kochel & Joshua Osborne Legit?

The broker’s customers can download a plugin for MT4 to use this information right on the chart of the platform. Analytical materials on Forex, commodity markets and stock indices are posted once a day, closer to the middle of the European session. Under the chart, you can read the list of news items by dates, which are related to AAPL.

The platforms have the opportunity to customize needs and requirements through MAM or PAMM offerings. Just2Trade possibly has the largest number of

trading platforms available I’ve seen from an online broker. Of course, the

award-winning MetaTrader 4 and MetaTrader 5 platforms are available, but unlike

most other online brokers Just2Trade doesn’t stop there. They also offer the

powerful CQG Trading Platform, the ROX Premium platform, the Sterling Trader

Pro, and the Lightspeed Trader. ROX is a sophisticated electronic order management system with instant routing to exchanges, ECNs, market makers and MTFs world-wide.

#2 Futures and Options

In particular, there is a commission per share for the U.S. stock market, which we estimated as low. In the majority of other markets, the broker charges commission as a percentage of the trade volume, while its size ranges from average to high. Just2Trade offers 5 trading platforms including market-leading MetaTrader 4 and MetaTrader 5, CQG, Sterling Trader Pro, and ROX trading platform.

Lime Financial Review – Brokers – Investopedia

Lime Financial Review – Brokers.

Posted: Wed, 27 Feb 2019 05:09:37 GMT [source]

As always in Cyprus, the broker is regulated by the Cyprus Securities and Exchange Commission (CySEC), which in turn is overseen by the European Securities and Markets Authority (ESMA). Broker maintains up to 14 different types of user accounts on its platform. Unlike most of the online brokers surveyed, Just2Trade does have a minimum account size requirement, though its minimum of $2,500 should not be much of a hurdle to the vast majority of investors. The global social network, WhoTrades, allows traders to construct a personalized feed and discuss ideas, companies/securities, news, and strategies of interest.

Trading Conditions

Just2Trade is a crypto exchange and brokerage app that offers competitive fees for its users. It does not charge any deposit fees, and its trade and withdrawal fees vary depending on the exchange and the blockchain of the cryptocurrency. Just2Trade also offers a wide range of features, such as a user-friendly interface, a variety of payment methods, and 24/7 customer support. With its competitive fees and extensive features, Just2Trade is a great choice for those looking to trade cryptocurrencies. So you want to find a trustworthy cryptocurrency exchange alternative? Or perhaps you’re looking for a brokerage where you can buy some of the major cryptocurrencies and then do whatever you want with them?

- This is especially true if you only want to concentrate on the main crypto assets on the market, such as Bitcoin or Ethereum.

- And if your friend funds the account, you will get an additional bonus of $29.

- In the majority of other markets, we estimated the broker’s commissions as high due to a considerable minimum commission per trade.

- Clients’ money in US is protected by Securities Investor Protection Corporation (SIPC), in Cyprus – by the government’s Investors Compensation Fund.

According to our analysis, the majority of Just2Trade customers come from Russia and its neighbor countries. All information on 55brokers.com is only published for general information purposes. We do not present any investment advice or guarantees for the accuracy and reliability of the information. To start trading with Just2Trade, you will have a choice to choose from GBP, EUR, USD, and more currencies, and select 20+ funding methods including Bank Wire, Credit/Debit cards, Skrill, Neteller, etc. Using free market research of Just2Trade’s experienced analyst team, clients get the opportunity to create their own investment strategies.

Learn to Trade

As such we may earn a commision when you make a purchase after following a link from our website. All the above are broker-assisted plans and also include an additional fee of $20 per trade. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. We have scanned fees (minimal spreads) that Just2Trade charges when trading popular currency pairs, here is their breakdown in pips. Partnership program is another way to receive additional bonus from working with Just2trade. If your friend opens an account with the broker upon your referral, the broker will give you a $6 bonus.

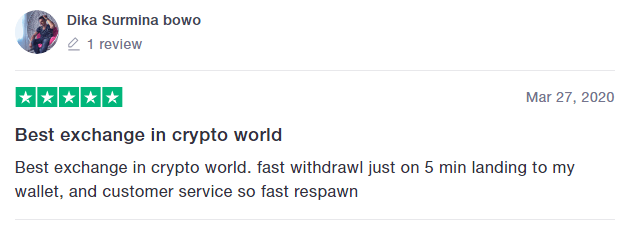

Degiro does not offer any similar products, while Swissquote only has Robo-Advisor (minimum 10,000 CHF) and Theme trading. The information about IPO is updated regularly on the website and the customers have access to purchase shares before they are in free circulation at the exchange. Trading with Just2trade, you receive access to the most popular exchanges of the world. Customer service is reported to be very

friendly and helpful, and we found that to be the case when we contacted them

to answer some basic questions regarding the accounts at Just2Trade. Match any two of these requirements to qualify as a professional client. The broker provides the latest market news from the world of economics and finance.

Investment portfolios are calculated individually for each client, based on the results of a questionnaire with 8 questions to determine your preferred risk preferences. Its main goal is to promote efficient, transparent and integrated financial trading infrastructure, ensuring a higher degree of investor protection. The directive contains measures for the organisation and functioning of investment firms, facilitating cross border trading, while creating strategic opportunities.

Besides providing direct market access (DMA), low commissions, the multi-regulated brokerage provides a modern high-speed infrastructure for instant trade execution. Overall, I feel that Just2Trade are a really good broker with a vast range of trading products and services that can meet the demands of all traders. They have plenty of experience and are regulated which gives me the peace of mind that I can trust them for my daily trading activity.

Just2Trade provides 24/7 customer support via Phone lines and Email. For customer support reasons, the broker has opened representative offices in almost all major locations covering most of Europe and Asia. Also, traders always need to consider swap or rollover fees which may be charged for positions held open for longer than a day. Just2Trade https://forex-reviews.org/just2trade/ offers all the usual deposit and

withdrawal methods you’d expect, such as wire transfers, credit cards, PayPal,

and online web wallets like Skrill and Neteller. With the exception of wire

transfers, funding is immediate for other funding methods. Withdrawals are just

as clear, with most withdrawal methods taking 2-3 business days.

Margin requirements for long stock positions are based on the share price. Stocks valued at $3.00 or less per share demand 100% margin (for both initial and maintenance margin). Just2Trade also outperforms Interactive Brokerage Services in terms of options trading costs.