Content

Our Compliance Kit & Seal, which is included in our Standard and Complete Incorporation Services, has all the items necessary for holding and documenting the organizational meeting. Come tax time, S corps must distribute the Schedule K-1 form to shareholders, indicating their annual profits or losses from the company, and file Form 1120-S with the Internal Revenue Service . Operating under its home state’s corporation statutes, it establishes a board of directors and corporate officers, bylaws, and a management structure. Its owners cannot be held personally or financially liable for claims by creditors or against the company. Both S corps and LLCs are known as „pass-through entities“ because they pay no corporate taxes but instead pay their shareholders, who are responsible for the taxes due.

- If you incorporate through BizFilings, simply complete our online order form or place an order by phone, and we prepare and file your Articles of Incorporation.

- Easily add copies of needed documents and view your in-progress forms.

- The business is responsible for reporting all financial activity on Form 1120S and attaching a Schedule K-1 for each shareholder.

- The signed and dated IRS forms 4549 and 870 need to be included with the amended return, along with the 1574 letter, if available.

In the event of a disagreement or discrepancy between the translation and the original English version of this web site or any notice or disclaimer, the original version will prevail. Revenue AnalysesResearch estimates of how state House and Senate bills could affect revenues and the Minnesota tax system. Minnesota Administrative RulesAdministrative rules adopted by the Department of Revenue to administer Minnesota tax laws. We’ll send a consolidated invoice to keep your learning expenses organized. Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia. Searches 500 tax deductions to get you every dollar you deserve.

Services

A shareholder is any person, company, or institution that owns at least one share in a company. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. More self-employed deductions based on the median amount of expenses found by TurboTax Premium customers who synced accounts, imported and categorized transactions compared to manual entry. For all required information and to determine where to file the form.

- To avoid interest and penalty assessments, estimated taxes should be paid on or before the original due date.

- Once the IRS completes the audit, a corporation has 180 days to file an amended return with SCDOR.

- The SCDOR has no role in requiring a Certificate of Authority with the SCSOS to do business in South Carolina.

- The entire share of an S corporation’s income is taxed to shareholders, whether or not the income is actually distributed.

S corporations must indicate the number of shares of stock they want to authorize in the Articles of Incorporation. The number of authorized shares is the total number of shares available for an S corporation to issue to shareholders; however the S corporation does not need to issue the total number of authorized https://kelleysbookkeeping.com/ shares. Some opt to hold unissued shares in order to add additional owners at a later date or increase the ownership percentage for a current shareholder. An issued share of stock shows ownership in the S corporation and each shareholder obtains a certificate representing the ownership value of the S corporation.

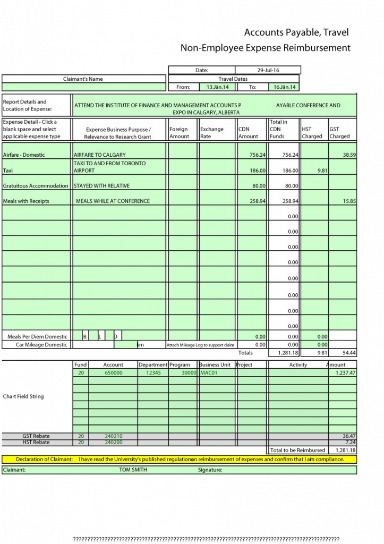

Chart 2 – S Corporation Shareholders

The amount of the corporation’s total receipts and if they were less than a specified amount. The registered agent for a business must be available during normal business hours to accept important documents as they are delivered. If you are often on the go or work irregular business hours, having BizFilings as your registered agent ensures that you never miss these important communications. Generally S corps are audited less frequently than sole proprietorships. Discover how to successfully manage your business with BizFilings‘ tips & resources on compliance, business expansion, obtaining a registered agent, & much more.

A corporation classified by the IRS as an „S“ corporation may exclude all or part of its income derived from the activities of the corporation, depending upon the domicile of the shareholders. Shareholders who are Louisiana residents are required to file a Louisiana individual income tax return to report their portion of the income derived from the activities of the corporation. As a pass-through entity, LLC owners also have tax benefits under the Tax Cuts and Jobs Act, just as S corp owners do. Yes, you can file an amended return electronically through the LDR Fed/State e-file program. The LDR Corporation E-file program for corporation income and franchise tax returns is available starting with the 2008 tax year. S Corp Tax Returns are different from the returns of other business entities in that an S corporation does not pay any tax to the Internal Revenue Service .

S-Corporation Tax Return Instructions

(In the U.S., corporations are currently taxed at a flat rate of 21%.) Any dividends or other profits are then distributed to shareholders with after-tax funds. S corps, by contrast, are exempt from federal tax on most earnings—there are a few exceptions on certain capital gains and passive income—so they can distribute more gains to stockholders. Specifically, S corporations offer the limited liability protection of the corporate structure—meaning that an owner’s personal assets can’t be accessed by business creditors or legal claims against the company. But like partnerships, they don’t pay corporate taxes on any earnings and income that they generate. They can also help owners avoid self-employment tax, if their compensation is structured as a salary or a stock dividend.

That notification will allow the Department of Revenue to close the Louisiana Revenue account number. Returns need to be filed until the corporation’s charter is dissolved, liquidated, or withdrawn through the Louisiana Secretary of State. All owners of residential rental property within the City of Portland are required to register their residential rental unit and may owe the Residential Rental Registration fee. If you own residential rental property in the City of Portland, please complete the Schedule R and include it with your Combined Tax Return. All taxes must still be paid by the original due date of the return.